3 Financing Options for Your Next Home Improvement Project

Whether it be through a tour of the , an episode of your favorite home design show, or a few scrolls through social media, by now you’ve likely been introduced to the latest home trends for 2024. Depending on what piqued your interest, you could be finding yourself on the exciting path toward remodeling your home. The question remains: how will you pay for it?

The most straightforward methods would include paying with cash or putting the charges onto a credit card. However, before you tap into your savings or rack up a big credit card bill, you might want to consider other options for bringing your inspiration to life – specifically those that allow you to utilize your home’s equity.

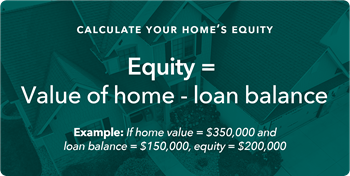

Simply put, equity is the current appraised market value of your home less the balance of any loans you have tied to the property. If you have a fair amount of equity built up (at least 20%), it can be leveraged to secure low-interest loans to fund just about anything – including your home remodeling projects.

the current appraised market value of your home less the balance of any loans you have tied to the property. If you have a fair amount of equity built up (at least 20%), it can be leveraged to secure low-interest loans to fund just about anything – including your home remodeling projects.

Let’s take a closer look at your options when it comes to equity-based financing.

Should I remodel if I’m going to sell?

Focus on repairing anything that’s noticeably broken or worn first. Then, compare the state of your home to competing homes for sale to determine which areas of your home need the most attention. Finally, consider the cost of your proposed improvements against the home’s market value after they’re complete. Some upgrades – such as replacing windows or remodeling the kitchen – will yield a higher return on investment than others.

1. Home Equity Loan

Planning a larger renovation, perhaps even with a solid bid from a contractor already in place? If you’re ready to put your plans into motion now and know how much you plan to spend, a home equity loan is probably your best bet. Occasionally referred to as a second mortgage, this is an attractive option for bigger, one-time expenses like getting a new roof or funding large-scale home renovations. It’s also great if you prefer fixed monthly installments for your repayment plan.

2. Home Equity Line of Credit (HELOC)

On the other hand, a home equity line of credit makes more sense if you want to access the available equity in your home as the need arises, which might be the case if you’re completing a lengthy project or a series of projects. This scenario works much like a credit card in the sense that there’s a maximum amount you can borrow, and you make installment payments with typically lower rates of interest. It’s different from a home equity loan because you are pulling from a line of credit, not receiving a lump sum of cash up front. If your project is going to be occurring over a longer period of time, a HELOC offers the flexibility to only borrow what you need, when you need it.

If relying on equity to fund your latest project isn’t an option (or preference) for you, there is a way to get credit for being a homeowner without tapping into your equity or savings.

3. Homeowners Xpress Loan

With a Homeowners Xpress Loan from Community First Credit Union, you can leave your equity untouched and access additional funds as soon as the same day, without having to worry about closing costs or appraisals. Even better, you’ll save with a lower rate if your mortgage is with us. This is a great option for unexpected or spur-of-the-moment projects when you need money fast.

Enjoy a Return on Your Investment

Keep in mind, taking out a loan to fix up your home can increase its value, meaning there’s a chance you’ll get the money back when it comes time to sell. When you reach the point of wanting to buy or build, consider the financing options we have available.

Whatever season of life you’re in, home remodeling project you’re preparing to tackle, or future purchases you’re considering, let the experts at Community First help you find a way.

Talk to an Expert