Beware of These Life Insurance Beneficiary Mistakes

Life insurance has long been recognized as a useful way to provide for your heirs and loved ones when you die. While naming your policy's beneficiaries should be a relatively simple task, there are a number of situations that can easily lead to unintended and adverse consequences. Here are several life insurance beneficiary traps you may want to discuss with a professional.

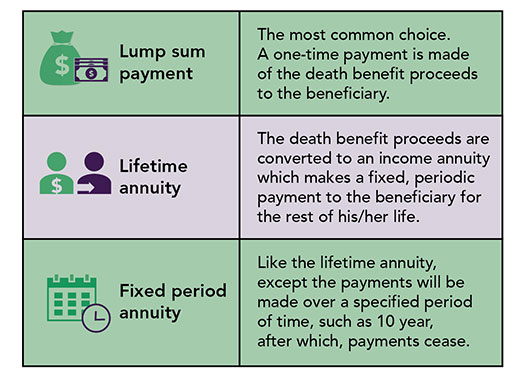

Life Insurance Payout Options

Most life insurance policies offer several options to the policy beneficiary, including:

Creating a Taxable Situation

Generally, life insurance death proceeds are not taxed when they're paid. However, there are exceptions to this rule, and the most common situation involves having three different people as policy owner, insured, and beneficiary. Typically, the policy owner and the insured are one and the same person. But sometimes the owner is not the insured or the beneficiary. For example, mom may be the policy owner on the life of dad for the benefit of their children. In this situation, mom is effectively creating a gift of the insurance proceeds for her children/beneficiaries. As the donor, mom may be subject to gift tax. Consult a financial or tax professional to figure out the best way to structure the policy.

As with most financial decisions, there are expenses associated with the purchase of life insurance. Policies commonly have mortality and expense charges. In addition, if a policy is surrendered prematurely, there may be surrender charges and income tax implications. The cost and availability of life insurance depend on factors such as age, health, and the type and amount of insurance purchased.

While trusts offer numerous advantages, they incur up-front costs and often have ongoing administrative fees. The use of trusts involves a complex web of tax rules and regulations. You should consider the counsel of an experienced estate planning professional and your legal and tax advisors before implementing such strategies.

Non-deposit investment products and services are offered through CUSO Financial Services, LP ("CFS") a registered broker-dealer (Member FINRA/SIPC) and SEC Registered Investment Advisor. Products offered through CFS: are not NCUA/NCUSIF or otherwise federally insured, are not guarantees or obligations of the credit union, and may involve investment risk including possible loss of principal. Investment Representatives are registered through CFS. The Credit Union has contracted with CFS for investment services. Atria Wealth Solutions, Inc. ("Atria") is a modern wealth management solutions holding company. Atria is not a registered broker-dealer and/or Registered Investment Advisor and does not provide investment advice. Investment advice is only provided through Atria's subsidiaries. CUSO Financial Services, LP is a subsidiary of Atria.

Copyright 2006- Broadridge Investor Communication Solutions, Inc. All rights reserved.

Broadridge Investor Communication Solutions, Inc. does not provide investment, tax, or legal advice. The information presented here is not specific to any individual’s personal circumstances.